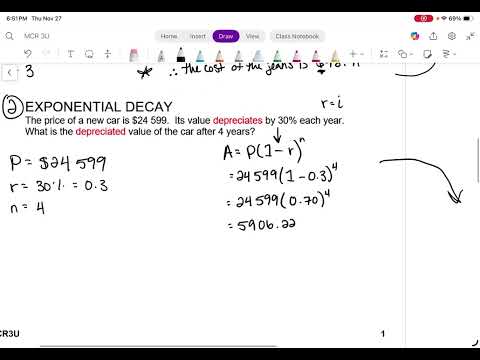

This lesson focuses on annuities due, where payments are made at the beginning of each period instead of the end. We compare annuities due with ordinary annuities and use that structure to find the future value, required payment, and present value using the appropriate formulas. Along the way, we look at real-world-style examples (like rent, insurance premiums, and savings plans pulled from each paycheck) and point out common algebra and setup mistakes, especially around timing, compounding, and the extra adjustment pieces in the formulas. 0:00 Lesson Intro 1:30 Annuity Due 2:21 Future Value 5:14 Example 1 11:54 How to Find Payment Amount 12:30 Example 2 18:25 Present Value 18:43 Example 3 25:47 Common Mistakes 26:32 Key Takeaways 🎓 I’m Dr. B. I teach math in a clear, steady way that helps close the gap between how many adults learned math and how students learn it today. 🧠 Whether you’re reviewing a skill, supporting your child, or rebuilding confidence, you’ll find explanations that connect the steps to real understanding. ✨ My hope is that each video helps people feel confident in their own understanding, not just in what an AI tool or program can tell them. 💬 Drop any questions in the comments and share with someone who could use the help! Continue the Mathematics of Finance full lesson series 👉🏽 #Annuities #FutureValue #SinkingFunds #DrBTeachesMath #ClosingTheGap #LearningWithColors #MathConfidence #MathHelp #MathMadeEasy #13240504

- 9Просмотров

- 1 неделя назадОпубликованоDr. B Teaches Math

Annuity Due and Future Value Explained | Full Mathematics of Finance Lesson

Похожее видео

Популярное

Стражи правосудия

Голие школьниц

томас и его друзья джеймс

Красна я гадюка 6

ну погоди 18 конец

Classic caliou misbehaves on a road trip

asmr tongue rubing

Lying ear picking

agustin marin i killed windows

Koktebel

чаггингтон

Сэмми и друзья

Preview 2 stars in the sky v4

психушка

дисней добрлас игрушки

Mardi Gras

Bing.get grounded

klaskyklaskyklaskyklasky no mix joey 2 do go

РЫЦАРЬ МАЙК

Бурные безросудок

Я вспоминаю

Preview 2 oh yeah

Darn David house

Голие школьниц

томас и его друзья джеймс

Красна я гадюка 6

ну погоди 18 конец

Classic caliou misbehaves on a road trip

asmr tongue rubing

Lying ear picking

agustin marin i killed windows

Koktebel

чаггингтон

Сэмми и друзья

Preview 2 stars in the sky v4

психушка

дисней добрлас игрушки

Mardi Gras

Bing.get grounded

klaskyklaskyklaskyklasky no mix joey 2 do go

РЫЦАРЬ МАЙК

Бурные безросудок

Я вспоминаю

Preview 2 oh yeah

Darn David house

Новини