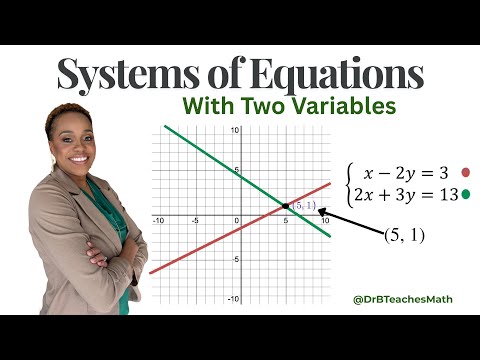

This lesson explains what the effective rate, or annual percentage yield (APY), really is and how it compares to the nominal (stated) interest rate. We use the APY formula to see how compounding affects the true rate you earn or pay, and work through examples that compare different banks and compounding periods. By the end, you’ll be able to read an advertised rate and understand what it actually means for your money. 0:00 Lesson Intro 0:45 The Annual Percentage Yield (APY) 2:24 Nominal Rate vs Effective Rate 4:40 Effective Rate (APY) Formula 6:07 Example 1 10:44 Why Does This Matter 11:45 Example 2 15:17 Common Mistakes 16:08 Key Takeaways 🎓 I’m Dr. B. I teach math in a clear, steady way that helps close the gap between how many adults learned math and how students learn it today. 🧠 Whether you’re reviewing a skill, supporting your child, or rebuilding confidence, you’ll find explanations that connect the steps to real understanding. ✨ My hope is that each video helps people feel confident in their own understanding, not just in what an AI tool or program can tell them. 💬 Drop any questions in the comments and share with someone who could use the help! Continue the Mathematics of Finance full lesson series 👉🏽 #CompoundInterest #EffectiveRate #APY #MoneyMath #DrBTeachesMath #ClosingTheGap #LearningWithColors #MathConfidence #MathHelp #13240502

- 19Просмотров

- 2 недели назадОпубликованоDr. B Teaches Math

Effective Rate (APY) Explained | Full Mathematics of Finance Lesson

Похожее видео

Популярное

double trouble die of death lms

настя катя

bungalow colony

макс и катя новогодний

Городской снайпер 3

jewish girls

健屋

Fap teen

Грань правосудия 5

веселая-карусел-14

Цена отказа 8 серия

Городской снаипер 2

Грань правосудия 5

Потерянный снайпер 1 серия

потерений снайпер

безжалостный гений 5сезон

Улица сезам

ТЁМА И ЛИЗА СТРОЯТ

Universal weird code

barefoot jewish women

Disney effects

массаж поджелудочной

алиса в стране чудеса

Красная гадюка 6

настя катя

bungalow colony

макс и катя новогодний

Городской снайпер 3

jewish girls

健屋

Fap teen

Грань правосудия 5

веселая-карусел-14

Цена отказа 8 серия

Городской снаипер 2

Грань правосудия 5

Потерянный снайпер 1 серия

потерений снайпер

безжалостный гений 5сезон

Улица сезам

ТЁМА И ЛИЗА СТРОЯТ

Universal weird code

barefoot jewish women

Disney effects

массаж поджелудочной

алиса в стране чудеса

Красная гадюка 6

Новини