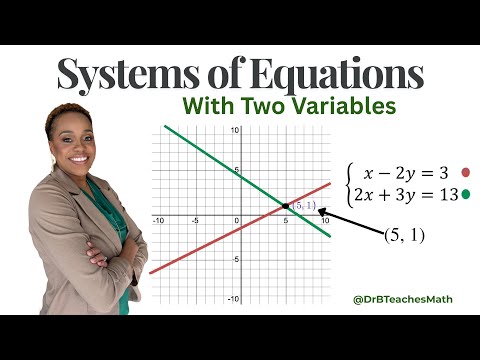

This lesson looks at ordinary annuities, where equal payments or deposits are made at the end of each period. We use timelines and formulas to find the future value, the payment amount needed to reach a goal, and the present value of a stream of payments, including examples with savings plans, sinking funds, and structured settlements. Along the way, we highlight how payment frequency, interest rate, and compounding period all need to line up for the math to work correctly. 0:00 Lesson Intro 3:26 Ordinary Annuity 4:47 Future Value 5:45 Walkthrough Future Value 15:25 Example 1 21:53 Sinking Funds & Example 2 28:37 How to Find Payment Amount 29:30 Example 3 34:05 Present Value 35:10 Example 4 40:36 Common Mistakes 41:15 Key Takeaways 🎓 I’m Dr. B. I teach math in a clear, steady way that helps close the gap between how many adults learned math and how students learn it today. 🧠 Whether you’re reviewing a skill, supporting your child, or rebuilding confidence, you’ll find explanations that connect the steps to real understanding. ✨ My hope is that each video helps people feel confident in their own understanding, not just in what an AI tool or program can tell them. 💬 Drop any questions in the comments and share with someone who could use the help! Continue the Mathematics of Finance full lesson series 👉🏽 #Annuities #FutureValue #SinkingFunds #DrBTeachesMath #ClosingTheGap #LearningWithColors #MathConfidence #MathHelp #MathOfFinance #MathMadeEasy #13240503

- 15Просмотров

- 2 недели назадОпубликованоDr. B Teaches Math

Ordinary Annuity, Future Value, and Sinking Funds Explained | Full Mathematics of Finance Lesson

Похожее видео

Популярное

Thiruttu payale amala paul

mickey mouse clubhouse

double trouble die of death lms

Волчий берег все серии

Красная гадюка 6 часть

Никелодеон реклама

Красная гадюка4

Безжалостный гений

Обриси

РЫЦАРЬ МАЙК

красный тарантул 3сезон

Красный тарантул 3

Universal gmajor

лалалупси шоколад

Он іздевался над женой

Бурное безрассудно 2серия

Фул школьниц

женитьба бальзаминова

телеканал детский

Rayton M01

Потерянній снайпер2

Preview 2 stars in the sky v38

Грань правосудия

Потерянный снайпер серия 2

mickey mouse clubhouse

double trouble die of death lms

Волчий берег все серии

Красная гадюка 6 часть

Никелодеон реклама

Красная гадюка4

Безжалостный гений

Обриси

РЫЦАРЬ МАЙК

красный тарантул 3сезон

Красный тарантул 3

Universal gmajor

лалалупси шоколад

Он іздевался над женой

Бурное безрассудно 2серия

Фул школьниц

женитьба бальзаминова

телеканал детский

Rayton M01

Потерянній снайпер2

Preview 2 stars in the sky v38

Грань правосудия

Потерянный снайпер серия 2

Новини