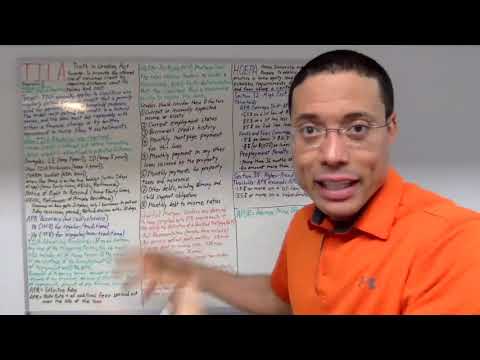

If you're preparing for the SAFE Mortgage Loan Originator (MLO) exam, understanding Regulation V, the Fair Credit Reporting Act (FCRA), and FACTA is a must. In this exam breakdown, I walk you through the structure, testable terms, and real exam-style questions you will likely face. Get NMLS exam flashcards for the SAFE MLO test at: 📘 Learn: - How to remember federal regulations like Reg Z, B, X, and V. - Mnemonics and memory tricks that simplify complex legislation. - What Regulation V covers and how it connects to FCRA and FACTA. - Important terms like adverse action, fraud alerts, opt-out rights, and red flag rules. - How FACTA protects against identity theft and what you need to know for test day. Chapters: 00:00 - Exam Breakdown Overview 02:54 - FCRA & Different Regulations 04:49 - Regulation V and FCRA 07:59 - Consumer Rights and Adverse Action 09:55 - Federal Mortgage Regulations Overview 11:20 - How FACTA Fights Identity Theft 13:40 - Credit Reports and Disposal Rule 18:22 - FACTA Recap and Vocabulary 30:01 - Practice Questions and Test Tips 🎓 Study these next! #NMLS

- 4610Просмотров

- 1 год назадОпубликованоDee Kumar Real Estate

FCRA and FACTA Explained for the NMLS Exam

Похожее видео

Популярное

Дорама вечная любовь

смешарики

poland warsaw metro ride from dworzec wilenski

harry sisson trump

шатун сериал

потерений снайпер

4 серия

Лальки развивалки

Семья от а до Я

барбоскины тайный

Тверская 2 сезон

ВИКТОРИНА ЗАКА

Дельфин 4

охотница

Потеряний снайпер 2 серія

ну погоди 17 выпуск

Потеряный снайпер 1

Universal gmajor

Universal g major 7

Потеряный снайпер 3 серия

Universal 1997 2012 g. Major 4

Красный тарантул 3 серия

барбоскины выпуск 8 диск

смешарики

poland warsaw metro ride from dworzec wilenski

harry sisson trump

шатун сериал

потерений снайпер

4 серия

Лальки развивалки

Семья от а до Я

барбоскины тайный

Тверская 2 сезон

ВИКТОРИНА ЗАКА

Дельфин 4

охотница

Потеряний снайпер 2 серія

ну погоди 17 выпуск

Потеряный снайпер 1

Universal gmajor

Universal g major 7

Потеряный снайпер 3 серия

Universal 1997 2012 g. Major 4

Красный тарантул 3 серия

барбоскины выпуск 8 диск

Новини