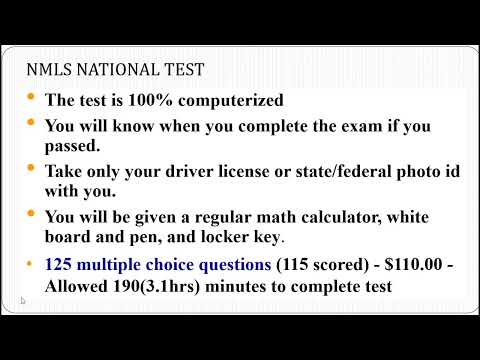

A breakdown of the most important SAFE MLO exam topics for those preparing for the NMLS mortgage loan originator test. Learn the difference between PMI and MIP, how the Qualified Mortgage rule affects underwriting, and the impact of credit scores on FHA loan eligibility. Plus, I cover discount points! If you're serious about passing, check out the mortgage exam prep bundle: 🎓 Learn: - When PMI applies and when it drops off. - Why MIP sticks for the life of an FHA loan. - When you can and can't buy down your rate. Whether you're just starting your mortgage licensing journey or need a refresher before test day, this breakdown helps you focus on what matters! Chapters: 00:00 - Personal and Professional Updates 04:07 - PMI vs. MIP 12:42 - FHA Loan Credit Score Requirements 15:51 - Loan vs. Good Faith Estimate 18:29 - Conforming vs. Non-Conforming Loans 23:32 - Qualified Mortgage Rule 30:12 - Title vs. Lien theory 34:19 - Borrowers and Discount Points ➡️ Now that you know the difference between PMI and MIP, learn the difference between the ability to repay rule (ATR) and interest rate next: #NMLS

- 4166Просмотров

- 9 месяцев назадОпубликованоDee Kumar Real Estate

PMI vs. MIP and Qualified Mortgages | NMLS Exam Prep

Похожее видео

Популярное

Родрі

agustin marin low voice i killed wi

Стражи правосудия 3 сезон

Поточний снайпер 2 часть

spit painting

Пороро акулы

Noddy

Потеряный снайпер 5 серия

poterianij snaiper 2 seria

Потерянный снайпер 2 часть

ТЁМА И ЛИЗА СТРОЯТ

Красная гадюка 3

Потерянный снайпер 6

Калимеро

потеряный снайпер 2 часть

Потеряный снайпер 1

ну погоди диск

МАКС 48

Universal 1997 logo remake prisma 3d

потеренный снайпер 2

Дорогу Нодди

бен 10

макс и катя тележка

потерянный снайпер

agustin marin low voice i killed wi

Стражи правосудия 3 сезон

Поточний снайпер 2 часть

spit painting

Пороро акулы

Noddy

Потеряный снайпер 5 серия

poterianij snaiper 2 seria

Потерянный снайпер 2 часть

ТЁМА И ЛИЗА СТРОЯТ

Красная гадюка 3

Потерянный снайпер 6

Калимеро

потеряный снайпер 2 часть

Потеряный снайпер 1

ну погоди диск

МАКС 48

Universal 1997 logo remake prisma 3d

потеренный снайпер 2

Дорогу Нодди

бен 10

макс и катя тележка

потерянный снайпер

Новини