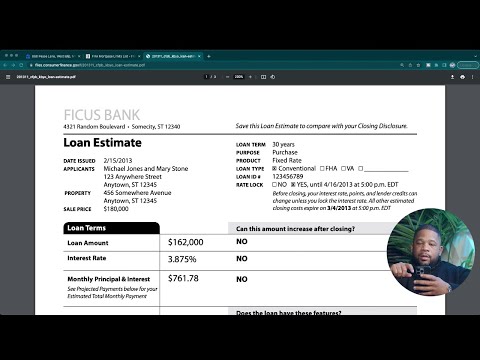

In this exam breakdown, I explain how changed circumstances impact the Loan Estimate under TRID rules. I cover what fees can and cannot change, tolerance levels, and how the timing of disclosures may be addressed on your NMLS exam. I go into zero-tolerance fees, 10% tolerance categories, and when lenders must re-disclose to remain compliant. I also provide examples of borrower-requested changes and regulatory changes, and how these affect timing rules for the loan estimate. Get NMLS exam flashcards at: 📘 Learn: - Examples of redisclosure triggers. - Why timing rules like the 3/7/3 are important. - What counts as a valid changed circumstance. - What penalties lenders face if they fail to comply. - How to remember fee tolerance levels for the exam. Chapters: 00:00 - NMLS Exam Breakdown Overview 06:49 - Changed Circumstances in Loan Estimates 13:54 - 0 vs. 10% Tolerance Fees 16:40 - Fees That Can Change at Any Time 18:43 - When Can a Loan Estimate be Revised? 20:59 - Consequences of Incorrect Fee Disclosures 22:15 - Summary 23:27 - TRID Changed Circumstances Scenario 24:48 - TRID Loan Estimate Timeline 28:28 - Recap ➡️ Learn about the mortgage loan origination process next: #LoanEstimate #NMLS

- 3434Просмотров

- 9 месяцев назадОпубликованоDee Kumar Real Estate

What is a Loan Estimate Change of Circumstance? (NMLS Exam)

Похожее видео

Популярное

Красная гадюка 2сезон

Etta Mae Hartwell

Дорогу Нодди

Koktebel

Красный тарантул 3

Грань провосудия 4серия

Потерянный снайпер 7 серия

Лихие 2

Красная гадюка5

МИСТЕР МЭН

Mufasa the lion king shaju

FeetSonatina

Волчий берег5серия

РЫЦАРЬ МАЙК

КАТУРИ

Dino Dan where the dinosaurs are

Фильм потеряны снайпер

томас и его друзья тоби

Walt Disney pictures 2011 in g major effects

ВЕЛОСПОРТ ЮРИЙ ПЕТРОВ .

мальчики

Лимпопо

опасность

dora dasha

Etta Mae Hartwell

Дорогу Нодди

Koktebel

Красный тарантул 3

Грань провосудия 4серия

Потерянный снайпер 7 серия

Лихие 2

Красная гадюка5

МИСТЕР МЭН

Mufasa the lion king shaju

FeetSonatina

Волчий берег5серия

РЫЦАРЬ МАЙК

КАТУРИ

Dino Dan where the dinosaurs are

Фильм потеряны снайпер

томас и его друзья тоби

Walt Disney pictures 2011 in g major effects

ВЕЛОСПОРТ ЮРИЙ ПЕТРОВ .

мальчики

Лимпопо

опасность

dora dasha

Новини