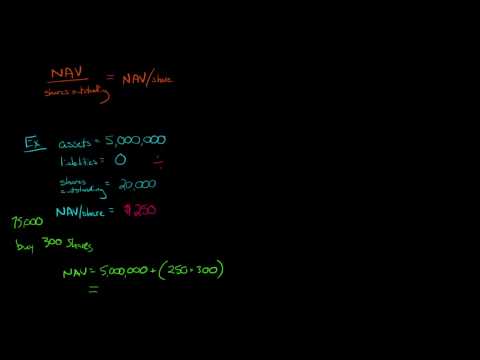

Understanding Net Asset Value (NAV) is essential for managing open-ended funds effectively. Learn how NAV impacts investor equity and fund valuation. To get started with your syndication or fund visit Net Asset Value (NAV) plays a crucial role in open-ended investment funds by ensuring fair valuation and equitable treatment of all investors. NAV helps in determining the value of a fund’s assets minus its liabilities, divided by the number of shares outstanding. This metric is essential for pricing new investments and assessing the performance of existing ones. NAV ensures that contributions from new investors reflect the true value of the underlying assets, preventing dilution of equity among investors. NAV is typically calculated at specific intervals, such as daily for mutual funds or quarterly/annually for real estate investments, due to the illiquid nature of real estate assets. Regular NAV calculation provides transparency, enabling investors to make informed decisions based on the fund's actual performance. Accurate NAV calculation involves determining asset values and understanding market fluctuations that affect these values. By understanding and accurately calculating NAV, fund managers can provide clear and reliable information to their investors, fostering a transparent and trustworthy investment environment. Chapters: 0:00 Introduction to Open-Ended Fund Challenges 0:35 Understanding Net Asset Value (NAV) 1:16 Whiteboard Example of NAV Calculation 4:02 The Problem NAV Solves 5:07 NAV Calculation in Mutual Funds 7:11 NAV Challenges in Real Estate 8:26 Quarterly and Annual NAV Determination 11:18 Key Takeaways on NAV 13:44 Closing Remarks and Contact Information Read more about Syndications & Funds – Structuring Your Capital Raise the Right Way: 👇 SUBSCRIBE TO THE MOSCHETTI SYNDICATION LAW GROUP YOUTUBE CHANNEL NOW 👇 Check out these Top Trending Blog Articles – 1.) What is Reg D? The King of Securities Exceptions - 2.) What is Syndication? Raising Outside Capital For Investment - 3.) Private Placement Memorandums for Syndications and Funds - 4.) Real Estate Syndication: Raising Investment Capital For Properties - Moschetti Syndication Law Group is a boutique syndication law firm, serving small and growth-bound syndicators, and well as private equity firms. We keep our firm ‘boutique’ size so we can tailor the services to each client’s unique needs without turning the firm into a faceless factory or passing unnecessary overhead expenses onto our clients. (As our client, you’ll only pay a fixed fee, so no surprises.) As for the client experience, we give real-time answers without making you book an official appointment. And we’ll work with your ambitions and overall vision to help you close the current deal and fill-in that ‘missing’ piece - whatever you need - to keep adding more syndications to your portfolio. We keep syndicators syndicating (TM). ★☆★ CONNECT WITH THE MOSCHETTI SYNDICATION LAW GROUP ★☆★ YouTube: Facebook: LinkedIn: Messenger: Web: #Syndication #PrivatePlacementMemorandum #PPM ------Disclaimer------ Also, please note, this video and any content from Moschetti Syndication Law Group, Tilden, or anyone affiliated with either or both, does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information from these online sources may not constitute the most up-to-date legal or other information. No viewer, user, or browser of content from us should act or refrain from acting on the basis of information on this site without first seeking legal advice from counsel in the relevant jurisdiction. Only your individual attorney can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.

- 2825Просмотров

- 2 года назадОпубликованоMoschetti Syndication Law PLLC

Understanding Net Asset Value: A Key Investment Tool For Private Equity Fund Managers And REITS

Похожее видео

Популярное

чужой район 2 сезон

Красная гадюка 5 серия

ну погоди амт

formation

потеряій снайпер 5 серия

Robinhood sreeleela songs

Городской снайпер

g major 26 turn normal

Красный тарантул 3

C p

Лимпопо

poland warsaw metro ride from dworzec wilenski

Universal not scary g major 4

Boo boo song

Boogeyman vs Stacy Keibler

Смешари

Красная кадыка 2

Стражи правосудтя

les amis de boubi

Big big family

губка боб

Dora FULL EPISODES Marathon!

przepraszamy za usterki

Красная гадюка 5 серия

ну погоди амт

formation

потеряій снайпер 5 серия

Robinhood sreeleela songs

Городской снайпер

g major 26 turn normal

Красный тарантул 3

C p

Лимпопо

poland warsaw metro ride from dworzec wilenski

Universal not scary g major 4

Boo boo song

Boogeyman vs Stacy Keibler

Смешари

Красная кадыка 2

Стражи правосудтя

les amis de boubi

Big big family

губка боб

Dora FULL EPISODES Marathon!

przepraszamy za usterki

Новини