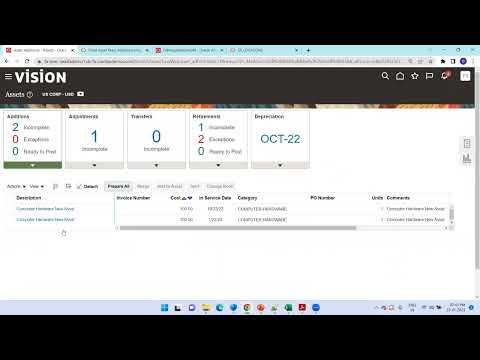

In this topic i will tell you the following: Overview Of Revaluing Assets Cloud What's Revaluation Methods Cloud What's Asset Revaluation Rules Cloud How to Enable / Setup Revaluation for an Asset Book in Oracle Cloud Revaluation of fixed assets is the process of increasing or decreasing their carrying value in case of major changes in fair market value of the fixed asset. International Financial Reporting Standards (IFRS) require fixed assets to be initially recorded at cost but they allow two models for subsequent accounting for fixed assets, namely the cost model and the revaluation model. Overview of Revaluing Assets Use revaluation to record assets in your asset books at their fair value. You can revalue assets to increase or decrease their carrying value whenever there's a change in the fair market value of the asset. Normally you perform revaluation of assets with sufficient regularity to ensure that the carrying amount doesn't differ materially from its fair value on the balance sheet date. Revaluation differs from planned depreciation, in which the recorded decline in value of an asset is tied to its use in business activities and age. Revaluation After revaluation, assets are carried in the books at their fair value as of the date of the revaluation, minus any: Subsequent accumulated depreciation Subsequent accumulated impairment losses Increase or Decrease in Carrying Cost: The revaluation results in either increasing or decreasing the carrying cost of an asset. Assets treats the increase or decrease as follows: Increase: Charged to the profit or loss account to the extent that it reverses a previous revaluation decrease of the asset. The balance, if any, is credited to revaluation reserve. Decrease: Debited to revaluation reserve to the extent of any credit balance existing in the revaluation reserve in respect to the asset. The balance, if any, is charged to the profit or loss account.

- 1574Просмотров

- 2 года назадОпубликованоMohammed Salah - (لوجه الله عز وجل)

Oracle Cloud Asset Revaluation: Centralize Control Of Your Business Assets

Похожее видео

Популярное

Красная гадюка 17 серия

сильвания фэмили реклама

Красная гадюка 16 серия

красний тарантул 8серия

Preview 2 stars in the sky v7

ПЧЁЛКА МАЙЯ

Обризи

потеряный снайпер 3 серия

Обриси

Потерянный снайпер 8серия

Лихач 7-9

Nickelodeon

Черная химера

5 серия

владом и никитой

Чужой район

Красна я гадюка

Стражи правосудия 5

Красная гадюка 11 серия

Лупдиду

красивая музыка

Красная кадыка 2

Ох и ах

КАТУРИ

сильвания фэмили реклама

Красная гадюка 16 серия

красний тарантул 8серия

Preview 2 stars in the sky v7

ПЧЁЛКА МАЙЯ

Обризи

потеряный снайпер 3 серия

Обриси

Потерянный снайпер 8серия

Лихач 7-9

Nickelodeon

Черная химера

5 серия

владом и никитой

Чужой район

Красна я гадюка

Стражи правосудия 5

Красная гадюка 11 серия

Лупдиду

красивая музыка

Красная кадыка 2

Ох и ах

КАТУРИ

Новини