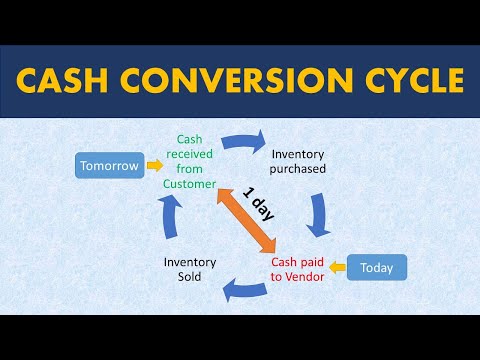

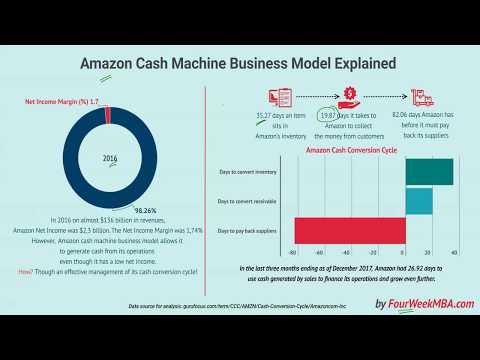

In this cash conversion cycle tutorial, we'll go over the finer details of what it means, its formula and step-by-step calculations. Following that, we will calculate the cash conversion cycle using the Colgate Case Study and interpret the findings. You can download the Colgate Cash Conversion Cycle template from this link - What is Cash Conversion Cycle? -------------------------------------------- The cash conversion cycle measures the time it takes for a company to turn its inventory and other inputs into cash. It takes into account how much time the company needs to sell inventory, collect receivables, and pay its bills. Formula -------------------------------------------- Cash Conversion Cycle Formula = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO) Interpretation of Cash Conversion Cycle -------------------------------------------- - A shorter cash conversion cycle is beneficial to a company since it allows it to buy, sell, and receive cash from customers more quickly and vice versa. For more details, you can refer to our article - 🔗 Watch the Full Playlist Here: 👩💻 Learn Step-by-Step: 📌 Part 1: 📌 Part 2: 📌 Part 3: 📌 Part 4: 📌 Part 5: 📌 Part 6: 📌 Part 7: 📌 Part 8: 📌 Part 9: 📌 Part 10: 📌 Part 11: 📌 Part 12: 📌 Part 13: 📌 Part 14: 📌 Part 15: 📌 Part 16: 📌 Part 17: 📌 Part 18: 📌 Part 19: 📌 Part 20: 📌 Part 21: 📌 Part 22: 📌 Part 23: 📌 Part 24: 📌 Part 25: 📌 Part 26: 📌 Part 27: 📌 Part 28: 📌 Part 29: 📌 Part 30: 📌 Part 31: 📌 Part 32: 📌 Part 33: Connect with us! YouTube ► LinkedIn ► Facebook ► Instagram ► Twitter ►

- 14840Просмотров

- 4 года назадОпубликованоWallStreetMojo

Cash Conversion Cycle - Meaning, Formula, Calculation & Interpretations

Похожее видео

Популярное

микки на фабрике смеха

городской снайпер 8 серия

feet city

Грань правосудия 4 сезон

ЗАБОТЛИВЫЕ МИШКИ

Лихач 2025

Красная гадюка 7

Handy manny Russisch

Потерянный снайпер сериал

Краснаямгадюка 2 сезон

ЛЕТНИЕ КАНИКУЛЫ С СИДОМ

asmr tongue rubing

Красная гадюка 5часть

Universal not scary in Luigi group

ВЕЛОСПОРТ ЮРИЙ ПЕТРОВ

КРАСНАЯ ГАДЮКА 13 serija

identity v

Обманшики

Красная гадюка4

губка боб

Дельфин 4

взлом карусели

blaze monster machines

городской снайпер 8 серия

feet city

Грань правосудия 4 сезон

ЗАБОТЛИВЫЕ МИШКИ

Лихач 2025

Красная гадюка 7

Handy manny Russisch

Потерянный снайпер сериал

Краснаямгадюка 2 сезон

ЛЕТНИЕ КАНИКУЛЫ С СИДОМ

asmr tongue rubing

Красная гадюка 5часть

Universal not scary in Luigi group

ВЕЛОСПОРТ ЮРИЙ ПЕТРОВ

КРАСНАЯ ГАДЮКА 13 serija

identity v

Обманшики

Красная гадюка4

губка боб

Дельфин 4

взлом карусели

blaze monster machines

Новини