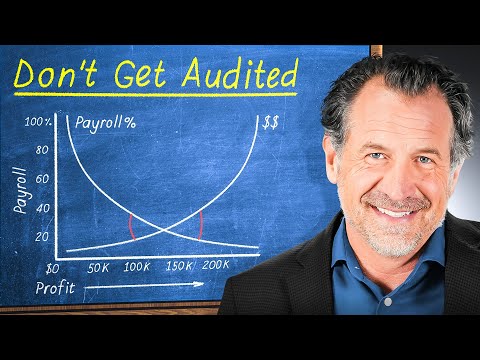

Are you paying yourself a reasonable salary as an S-Corporation owner? Are you confused as to what you should be paying yourself? And how? In this video, we walk through what the IRS expects, why reasonable compensation matters, and how to avoid the costly pitfalls that can arise from improper salary decisions. You’ll also learn how to evaluate your own circumstances objectively and what tools and services can help support your determination. You’ll learn: • What “reasonable compensation” means under IRS regulations. • Why choosing the right salary matters for tax savings and audit protection. • Common mistakes S-Corp owners make when setting their compensation. • The objective factors every owner should consider — industry data, duties, hours, profit levels, and more. • Professional services and reports that can support and justify your compensation determination. Why trust The Mattox Group? With nearly 20 years of guiding California entrepreneurs, professionals, and small business owners, The Mattox Group provides strategic, year-round advisory support to help you make confident and compliant business decisions. 📞 Schedule your consultation: 💌 Download our S-Corp Reference Guide: + 📺 Watch our full “Smart Business Structure” playlist: The right compensation strategy protects your business, strengthens your tax position, and supports your long-term financial goals. We’re here to help you make the choice with clarity and confidence. #scorporation #reasonableprice #businessformation #taxplanning #smallbusiness #taxtips #tmgadvisors

- 80Просмотров

- 1 неделя назадОпубликованоThe Mattox Group

S Corp Owners: Paying Yourself First - How to be successful and compliant with Your Salary!

Похожее видео

Популярное

Умизуми

красная гадюка сезон 2

asmr tongue rubing

ending 4134

оазис

томас и его друзья тоби

ДЕННИ И ДЕДДИ

Красная гадюка 17 серия

БУРНОЕ БЕЗРАССУДСТВО 3

потерянній снайпер

Дельфин 4

Lying ear picking

Божественний доктор

Boogeyman vs Stacy Keibler

Патеринний снайпер.4серия

лелик и барбарики

Гоу дигео

ну погоди 17-18 выпуски

Потерянный снайпер 6серия

Стражи проавосудия 5

the jerry springer show

ПОТЕРЯННЫЙ СНАЙПЕР2

Universal not scary in Luigi group

ПОТЕРЯННЫЙ СНАЙПЕР 2 серия

Стражи правосудия 3 сезон

красная гадюка сезон 2

asmr tongue rubing

ending 4134

оазис

томас и его друзья тоби

ДЕННИ И ДЕДДИ

Красная гадюка 17 серия

БУРНОЕ БЕЗРАССУДСТВО 3

потерянній снайпер

Дельфин 4

Lying ear picking

Божественний доктор

Boogeyman vs Stacy Keibler

Патеринний снайпер.4серия

лелик и барбарики

Гоу дигео

ну погоди 17-18 выпуски

Потерянный снайпер 6серия

Стражи проавосудия 5

the jerry springer show

ПОТЕРЯННЫЙ СНАЙПЕР2

Universal not scary in Luigi group

ПОТЕРЯННЫЙ СНАЙПЕР 2 серия

Стражи правосудия 3 сезон

Новини