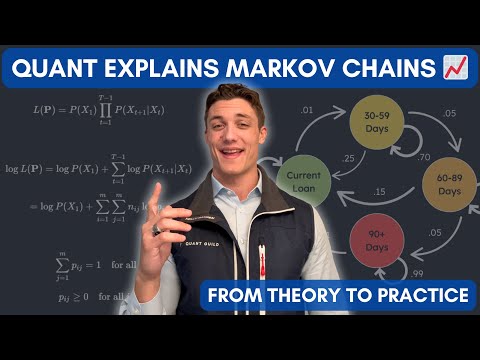

*🚀 Master Quantitative Skills with Quant Guild* *📅 Meet with me 1:1* *📈 Interactive Brokers for Algorithmic Trading* *👾 Join the Quant Guild Discord server here* ___________________________________________ *🪐 Jupyter Notebook* %20Video%20Lectures/51.%20Hidden%20Markov%20Models%20for%20Quant%20Finance/ **TL;DW Executive Summary** - Naïve random variable models can't capture dynamics we observe in real data - Unobservable data generating distributions we are trying to model change over time along with the parameters we are trying to estimate - Unobservable data generating distributions are likely a function of latent variables or processes (volatility, trend, . . .) that must be proxied for as these latent variables are themselves unobservable - We can model latent processes as a series of latent states using model proxies (historic or realized volatility, for example) and explicitly defining different states, theory and experience play a heavy role here - Markov Chains can effectively model these explicitly modelled latent states and better capture dynamics we observe in practice but certainly omit other latent processes or latent states that may improve the model - Hidden Markov Models compress the series of latent processes or states by learning from data, the number of states is a hyperparameter and there is no one-size-fits-all value - Though Hidden Markov Models may better capture the latent processes it does so perhaps by omitting explainability and may not outperform a simpler model that explicitly defines dynamics that captures the most variation in the desired data generating distributions I hope you enjoyed! - Roman ___________________________________________ *📖 Chapters:* 00:00 - Bridging the Gap Between Theory and Practice 03:40 - Modeling Uncertainty with Random Variables 07:08 - Example: Problems Modeling NVDA Returns 10:12 - Animation: Why Modeling Uncertainty is Difficult 12:04 - Latent Random Variables and Data Generating Distributions 15:34 - Example: Realized Volatility Process 18:02 - Recap: Challenges we Face in Practice 20:18 - Motivating Markov Chains with Latent States 22:40 - Modeling Latent States with Markov Chains 28:24 - Example: Volatility Regime Model 31:22 - Markov Chain Model Considerations 33:05 - Assessing the Efficacy Latent State Models 36:03 - Motivating Hidden Markov Models 38:58 - Hidden Markov Models 43:12 - Forward/Backward/Baum-Welch Algorithms 46:36 - Example: 3-State Hidden Markov Model 50:03 - TL;DW Executive Summary ___________________________________________ *🗣️ Shout Outs* A special thank you to my members on YouTube for supporting my channel and enabling me to continue to create videos just like this one! *⭐ Quant Guild Directors* Dr. Jason Pirozzolo ___________________________________________ *▶️ Related Videos* *Referenced Videos 👉* Markov Chains for Quant Finance Master Volatility with ARCH & GARCH Models *Quant Builds 🔨* How to Build a Volatility Trading Dashboard in Python with Interactive Brokers *Statistics and Trading Profitability Over Time (Edge) 📈* Expected Stock Returns Don't Exist How to Trade How to Trade Option Implied Volatility How to Trade with an Edge Quant on Trading and Investing ___________________________________________ *🗂️ Resources* *📚 Quant Guild Library:* *🌎 GitHub:* *📝 Medium (Blog):* ___________________________________________ *🛠️ Projects* *The Gaussian Cookbook:* *Recipes for simulating stochastic processes:* ___________________________________________ *💬 Socials* *TikTok:* @quantguild *Instagram:* *X/Twitter:* *LinkedIn (personal):* *LinkedIn (company):* ___________________________________________

- 20790Просмотров

- 4 месяца назадОпубликованоRoman Paolucci

Hidden Markov Models for Quant Finance

Похожее видео

Популярное

потеряный снайпер 2 часть

Китай сериали

Сезон охоты

Василь котович

красная гадюка все серії

Дельфин все серии

детский сад

Universal not scary in luig Mari

малыш вилли 03

владом и никитой

губка боб

Boo boo song with sam dominoki

ЛЯПИК ЕДЕТ В ОКИДО

Стражи правосудия 5

Красная гадюка все серии

Angry universal 2010

Tour of the lifts in White City

after 14 Years

стражи провосдия 3 сезон

Лихач 2025

Дорама вечная любовь

Жена чиновника 3 часть

Сэмми и друзья

Красная гадюка 16 серия

Баскервиллей

Китай сериали

Сезон охоты

Василь котович

красная гадюка все серії

Дельфин все серии

детский сад

Universal not scary in luig Mari

малыш вилли 03

владом и никитой

губка боб

Boo boo song with sam dominoki

ЛЯПИК ЕДЕТ В ОКИДО

Стражи правосудия 5

Красная гадюка все серии

Angry universal 2010

Tour of the lifts in White City

after 14 Years

стражи провосдия 3 сезон

Лихач 2025

Дорама вечная любовь

Жена чиновника 3 часть

Сэмми и друзья

Красная гадюка 16 серия

Баскервиллей

Новини